As we inch closer to 2025, many potential homebuyers and homeowners are asking the same question: Will mortgage interest rates finally go down? The answer depends on several economic factors, including inflation, Federal Reserve policies, and market demand. Let’s explore what experts are predicting for 2025 and what that could mean for you.

Understanding the Current Rate Environment

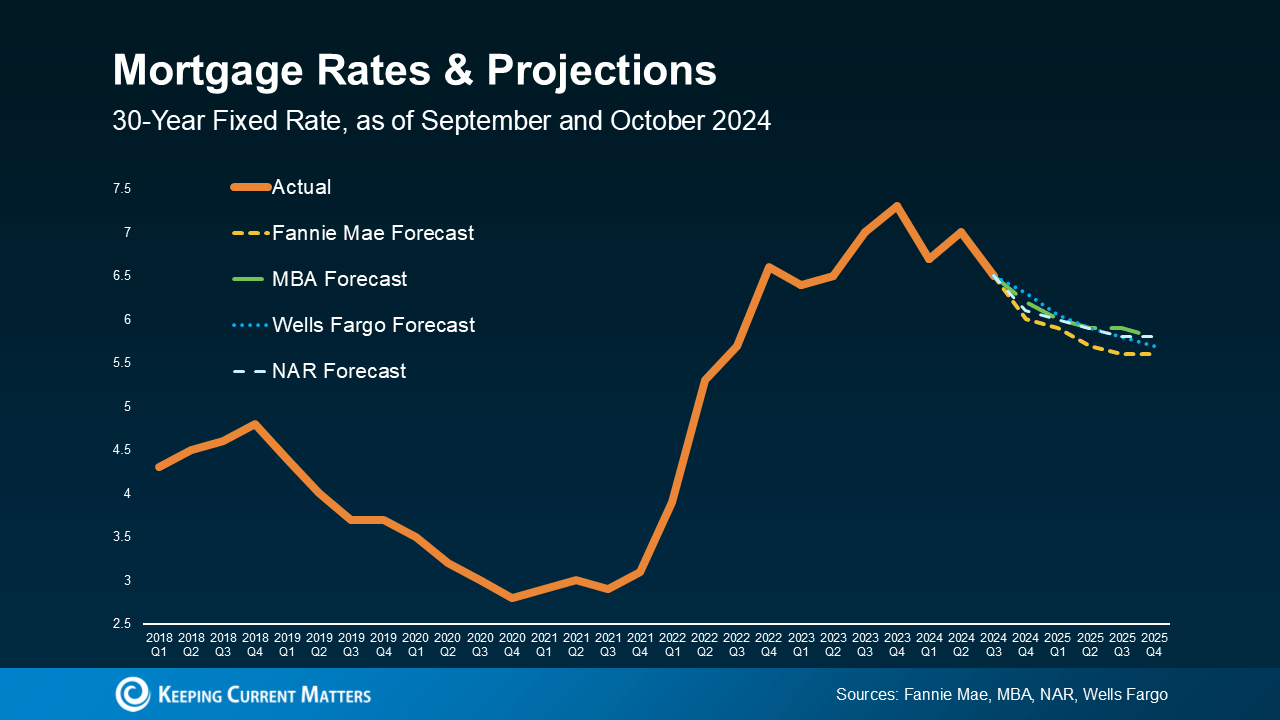

Mortgage rates have been on a rollercoaster ride over the past few years. The Federal Reserve’s aggressive rate hikes in 2023 and 2024 aimed to combat inflation, but these measures also pushed mortgage rates to multi-decade highs. According to CNBC, the average 30-year fixed mortgage rate has hovered around 7-8%, creating affordability challenges for many buyers.

While the Fed’s actions have slowed inflation, they have also slowed housing demand. As a result, industry experts predict that rates could begin to decline in late 2024 and into 2025 as the economy stabilizes.

What Could Drive Rates Lower in 2025?

Several factors might contribute to lower mortgage rates in 2025:

- Fed Rate Policy Changes

The Federal Reserve has indicated that it may pause or reduce rate hikes if inflation continues to decrease. A more dovish Fed policy could bring relief to mortgage rates. - Slower Economic Growth

Morningstar reports that slower GDP growth and cooling inflation could lead to reduced long-term interest rates. Historically, economic slowdowns often coincide with declining mortgage rates. - Increased Housing Supply

With new construction on the rise, increased housing inventory may alleviate some pressure on home prices, potentially impacting rates positively for buyers.

What Should You Do Now?

While it’s tempting to wait for lower rates, timing the market perfectly is nearly impossible. Instead, focus on what you can control. Here are some tips:

- Run the Numbers: Use our Mortgage Calculators to determine how different rates would affect your monthly payment and overall affordability.

- Prepare to Refinance: If you buy now at a higher rate, keep an eye on the market. When rates drop, refinancing could save you thousands over the life of your loan.

- Strengthen Your Finances: Improving your credit score and saving for a larger down payment can help you secure better terms, no matter where rates land in 2025.

What the Experts Are Saying

Financial analysts at Morningstar believe that economic conditions in 2025 could favor lower rates, but they also caution that unexpected geopolitical or economic events could disrupt these projections. Similarly, CNBC highlights that while there’s hope for rate relief, much depends on the Federal Reserve’s response to inflationary pressures.

Conclusion

While no one can guarantee that mortgage rates will go down in 2025, there are promising signs that relief may be on the horizon. Whether you’re a first-time homebuyer or looking to refinance, staying informed and prepared is key. Explore our Mortgage Calculators to plan your next steps and make the most of market conditions.

Have questions about your specific situation? Reach out to us today. We’re here to guide you through the ever-changing mortgage landscape.